Individual Tax Relief and Business Expenses. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

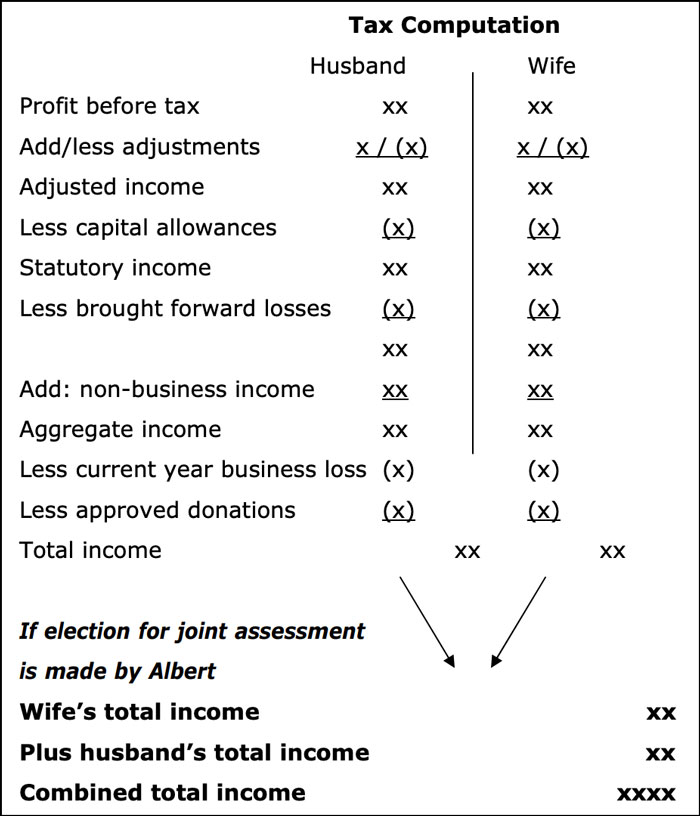

Joint And Separate Assessment Acca Global

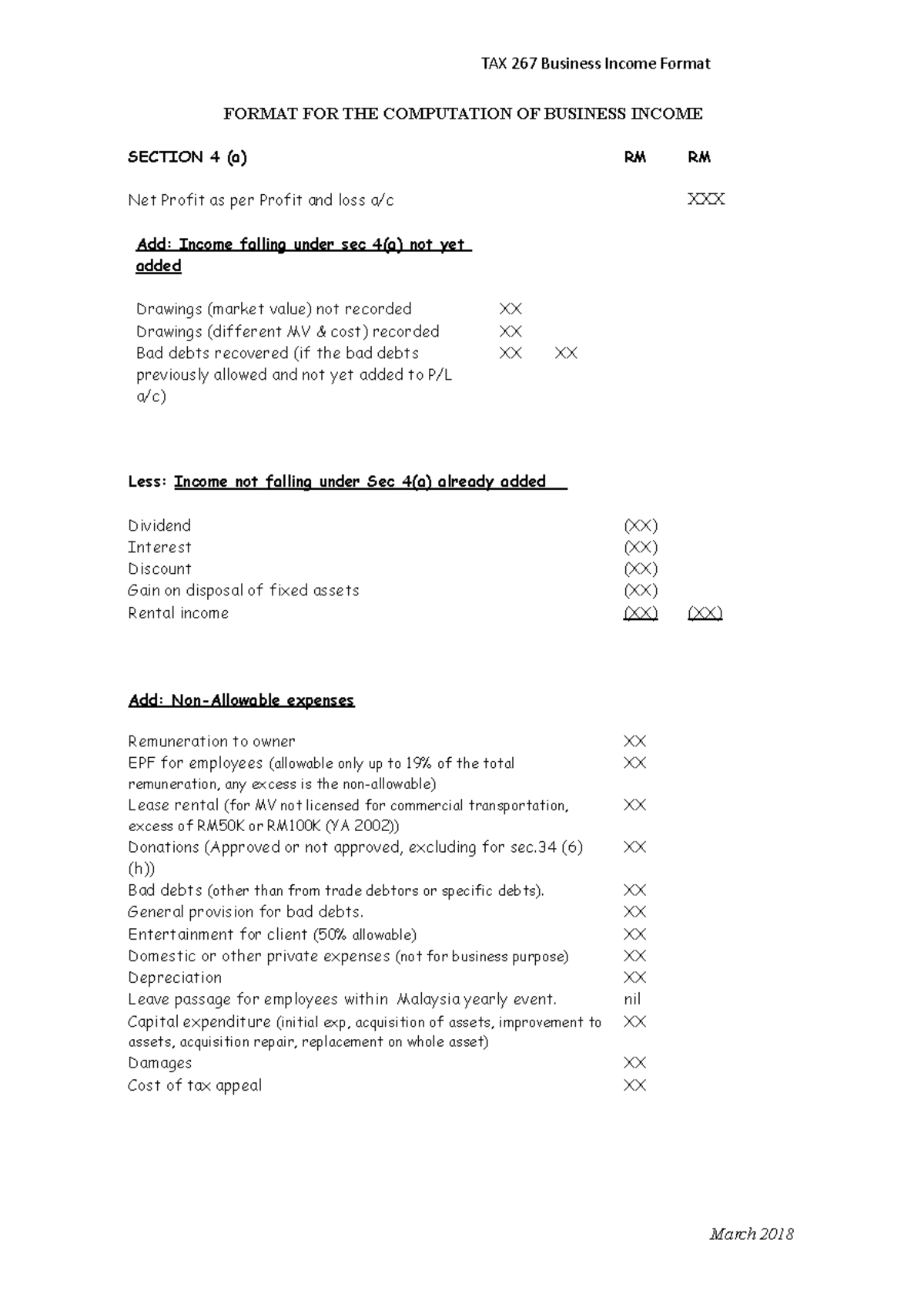

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax.

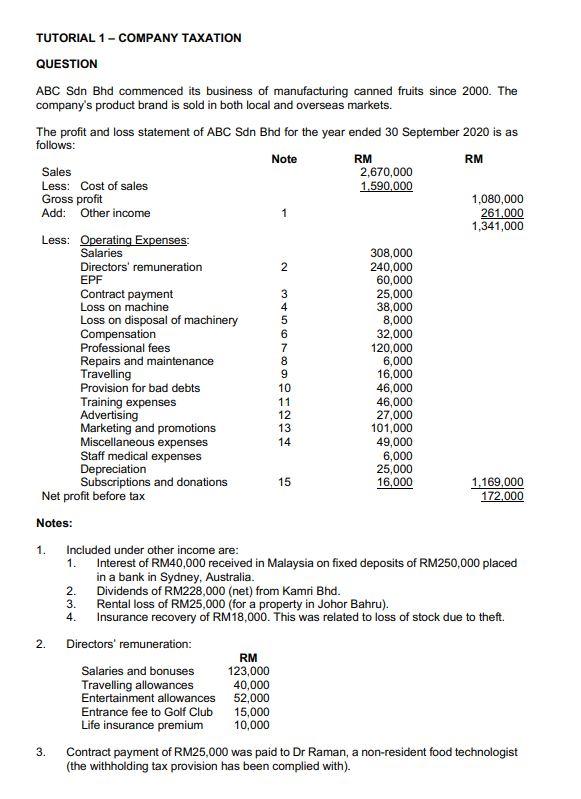

. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Contoh Format Baucar Dividen. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30. Following the Budget 2020 announcement in October 2019 the reduced rate. Company tax computation format 1.

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. The current CIT rates are provided in the following table. Your company should prepare its tax computation annually before completing its Form C-S Form C.

Return Form RF Filing Programme For The Year 2021 Amendment 42021. Tax Rate of Company. Headquarters of Inland Revenue Board Of Malaysia.

A True B False C True only for companies D True only for individuals and non-corporates 6 Lee is a Canadian employed by a Malaysian company. Paid-up capital up to RM25 million or less. On the chargeable income exceeding RM600000.

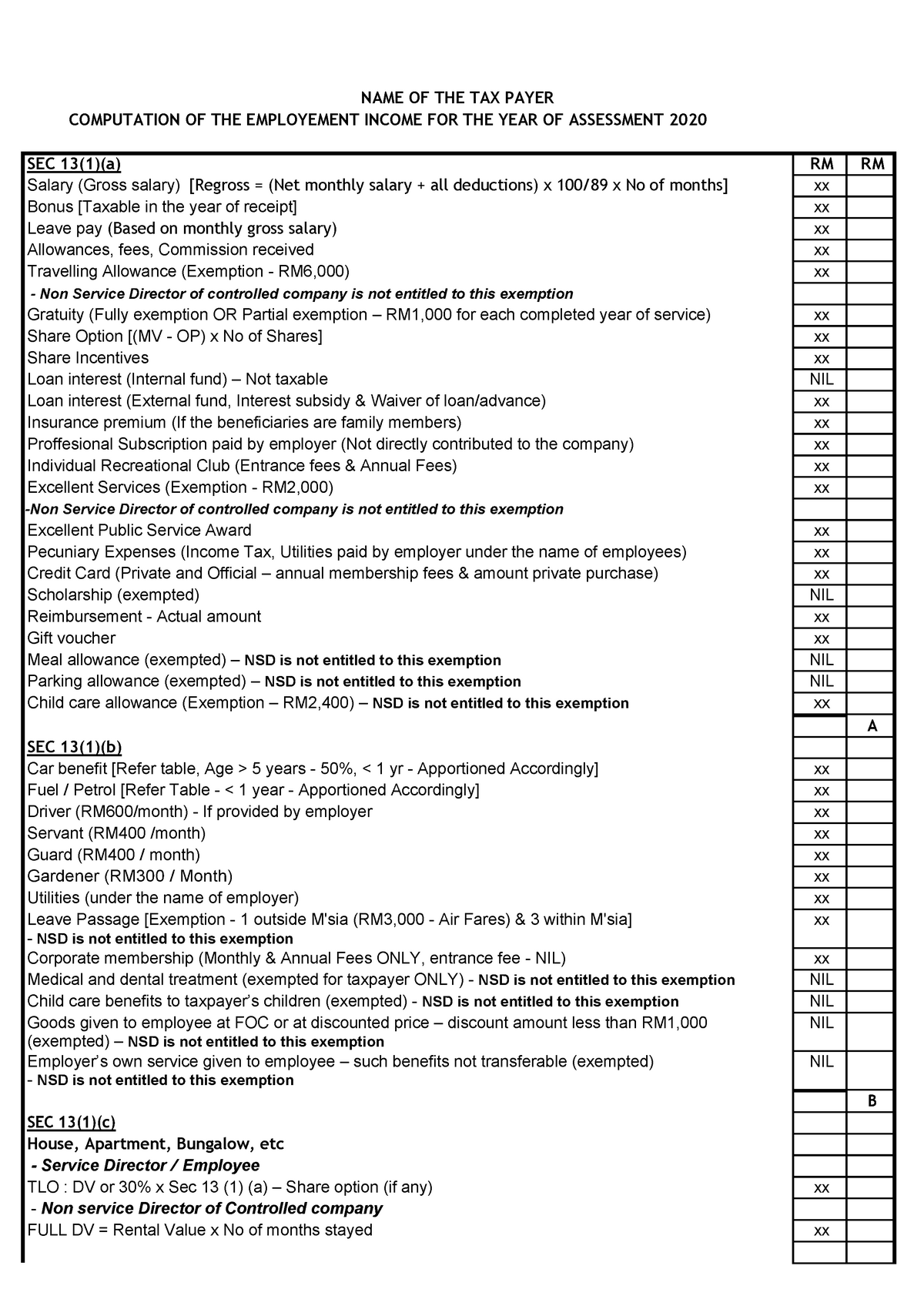

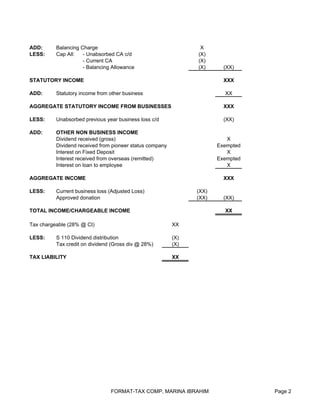

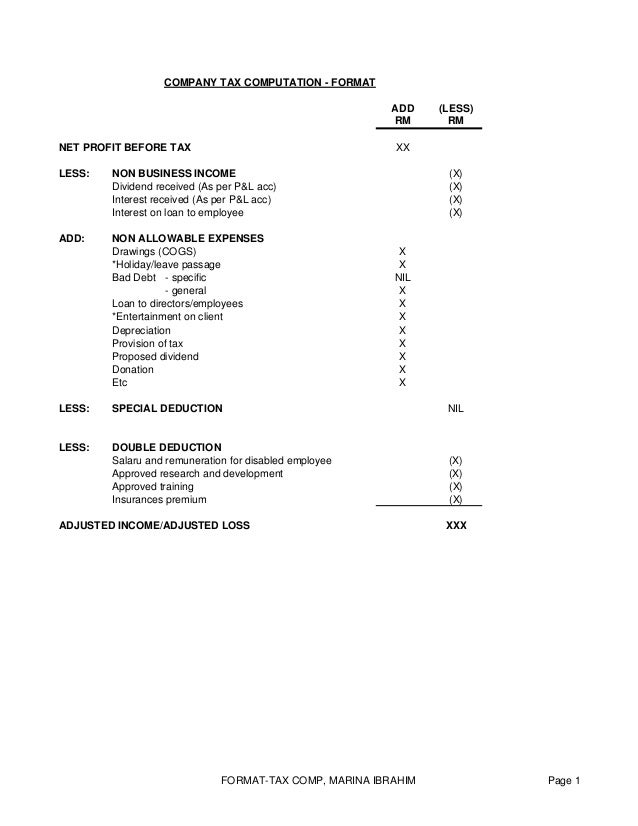

Individual Tax Relief and Business Expenses. Chargeable income MYR CIT rate for year of assessment 20212022. NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD.

3 This sample form CANNOT be used for the purpose of submission to. Resident company Paid-up ordinary share capital First Excess over RM500000 RM500000 RM2500000 or less 20 25 More than RM2500000 25 25 Non-residents Company 25 Individual 26 Personal reliefs and allowances RM Self 9000 Disabled self additional 6000 Medical expenses expended for parents maximum 5000. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

HK-23 - Computation of Tax Allowance. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances. Lee arrived in Malaysia on 1 June 2010 and.

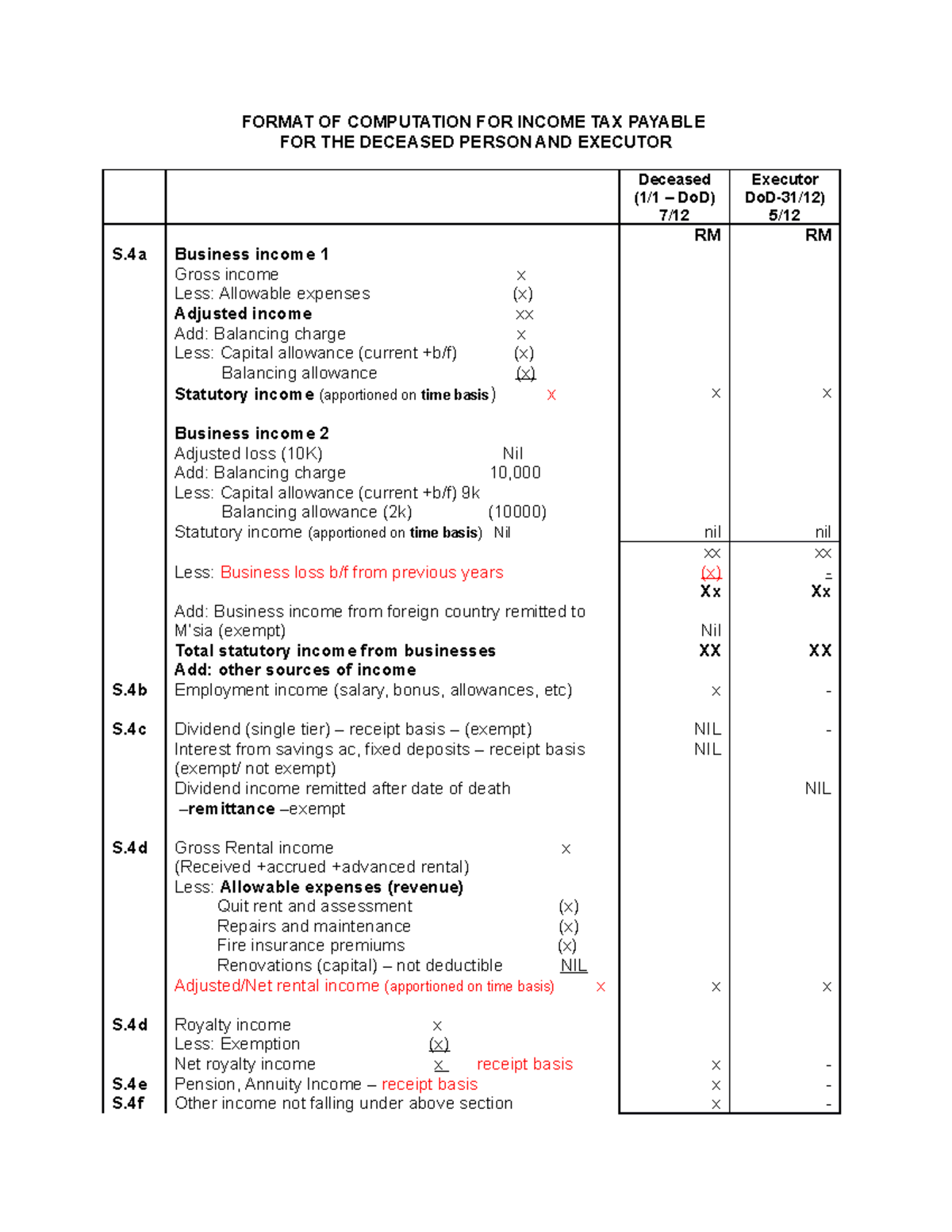

Income TaxWealth taxInt On TaxPenalty On Tax Shown As ExpDeferred Tax. Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis. Add Deduct - RM000 RM000 RM000 Business income.

NON ALLOWABLE EXPENSES Drawings COGS X Holidayleave passage X Bad Debt. Tax Rate Of Company. Income tax rates.

It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the Malaysian Inland Revenue Board IRB. I Mutiara Sdn Bhd Income Tax computation Year of assessment 2013. Following table will give you an idea about company tax computation in Malaysia.

7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. Return Form RF Filing Programme. Individual Business Income.

RM60000 with business income iii Tax p ayable in the name of the husband - RM2000000 iv Instalments paid by the husband - RM1000000. Dividends - single tier. Any Cash Payment 20000 Of Any Expense Per Day.

Illegal Exp Booked In P L. A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. Rate On the first RM600000 chargeable income.

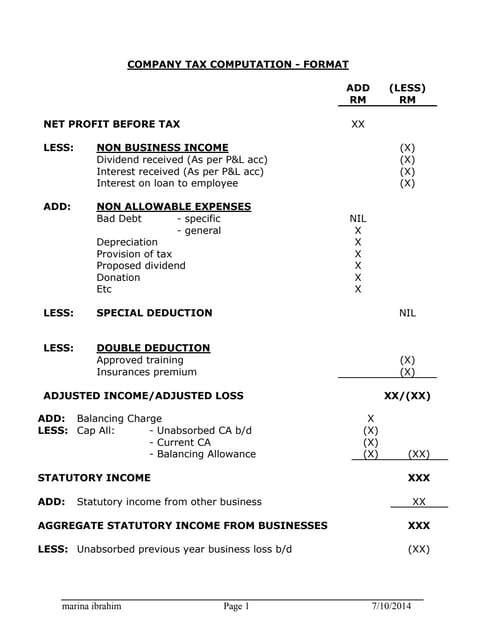

Tax Deduction Exemption. Section 43 B Expenses Interest On Bank LoanBonusPf Not Paid Till Return Filing Date 30 Sept. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

Last reviewed - 13 June 2022. 1 Due date to furnish Form e-C and pay the balance of tax payable. 5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above statement is.

Payments to foreign affiliates. NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD. Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are.

Income attributable to a Labuan business. 127556 Cost of sales. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Within 7 months after financial year end.

Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. Any Loan Taken Or Repaid 20000 In Cash. Corporate - Taxes on corporate income.

Individual Business Income. Headquarters of Inland Revenue Board Of Malaysia.

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

Company Tax Computation Format

Company Tax Computation Format 1

Format Computation Of Statutory Income For Sole Proprietorship Business For Ya Docx Computation Of Statutory Income For Business Sole Course Hero

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Malaysia Tax Computation Format Fill Online Printable Fillable Blank Pdffiller

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Company Tax Computation Format 1

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Computation For Individual Tax Liability For The Year Of Assessment 2019 Format Of Computation For Studocu

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Chapter 5 Computation Of Statutory Business Income Latest Pdf Bad Debt Expense

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Ktps Consulting Partnership Tax Computation 2019 Facebook

Company Tax Computation Format